Before we get into some of the reasons you might want to consider buying now vs. waiting, I wanted to sort of set the stage with some recent historical data.

It’s sufficed to say that from 2020 – NOW, the market has been anything but normal, or even stable! From Covid causing a temporary standstill in the market to the aftermath which brought on a buying frenzy, the likes of which we’ve never seen before (and likely never will again, at least to that extent).

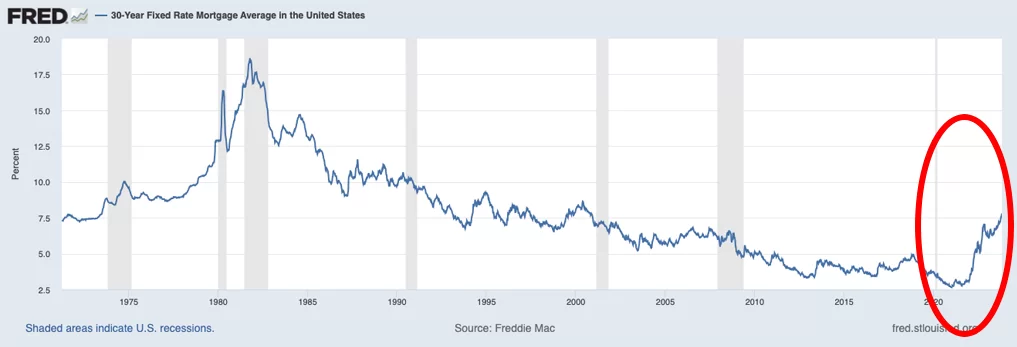

Couple that with basically free money and it was a recipe for chaos!

So let’s go back in time!

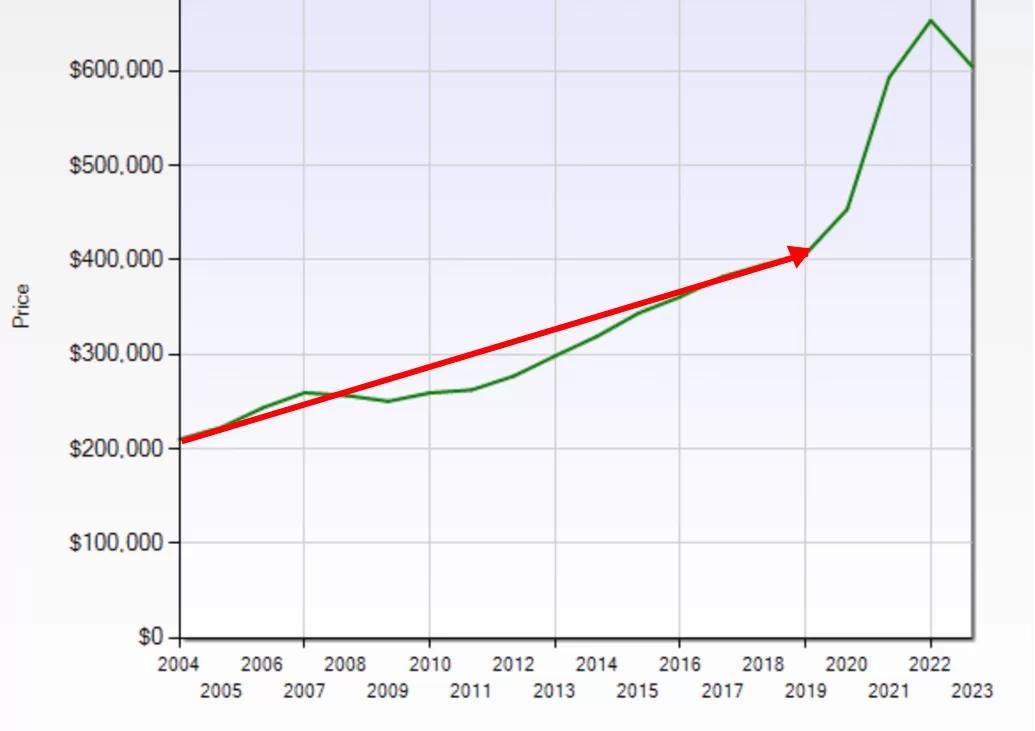

From 2004 to 2019, we saw an average annual appreciation of ~ 6.2%.

So what happened when Covid hit (and during the years that followed)?

Companies let employees work remotely so it created a HUGE opportunity for people to move to other markets (aka Central TX). Couple that with record low interest rates and people were able to afford a lot more house!

Properties were appreciating month over month by double digits in some cases! Homes got dozens of offers within hours of going on the market… and buyers got tired, burnt out and stressed out.

We saw appreciation SKYROCKET from January 2021 to April of 2022 to an average of 42%.

While we have seen a dip in values since then, over the past 36 months, we are still up 24.98% (in Travis, Hays and Williamson counties).

IMPORTANT: When it comes to home prices, the market is HYPER LOCAL. So, if you want to know precisely where your values are, please let me know. Even in our neighborhood, individual subdivisions have different levels of appreciation and/or declines.

We peaked in May of 2022 with an average closed price of $713K across the tri-county area. Interest rates hit the 5s in April of 2022 and have continued to rise. We are currently sitting around 8% with points. AND we had 10% fewer properties on the market in September of 2023 than we did in September of 2022.

So what does all this mean?

In a nutshell… We still have a BIG inventory problem. People sitting on 2.5%-4% interest rates are less likely to swap out to interest rates in the 8s unless the have a NEED to do so. (In fact, I’ve advised friends and clients that want to buy a new home to see if they can qualify while holding on to their existing home as a rental if it makes sense).

Once rates start to come down, we’re going to be right back in the bidding wars we saw over the past few years!

While buying right now may not be perfect for everyone, it is a GREAT time if you are in the position to buy,.

Here are 10 reasons why...

1. Limited Competition: High-interest rates have discouraged a lot of buyers, leading to less competition. Not only does this give you more inventory to choose from, but it also puts you in a strong position in terms of negotiations. Instead of waiving option periods, paying for title policies and not being able to get repairs included like we saw for years, we’re seeing discounts and concessions.

2. Motivated Sellers: As I mentioned above, many of the sellers that are selling now have some increased motivation… When I used to teach investors how to find motivated sellers, I had over 30 different “types” of motivation!

3. Refinance When Rates Drop: Many lenders are offering “free refis” when rates DO come back down. Experts don’t agree on when the rates are going to start to come back down, but pretty much everyone can agree that rates WILL drop in the coming months/years.

4. Inflation Hedge: Real estate often serves as a hedge against inflation. When interest rates are high, inflation is usually high as well. Owning property can protect your wealth from eroding due to rising prices.

5. Building Equity: Whether interest rates are high or low, every mortgage payment contributes to building equity in your home. This is generally a more productive use of your money compared to paying rent.

6. Tax Benefits: Mortgage interest is typically tax-deductible, and this advantage can be more substantial when interest rates (and therefore your mortgage interest payments) are high. For illustration purposes, let’s say you paid an extra $10,000 in interest and you’re in the 40% tax bracket, you’ll get a reduction of $4000 on your taxes, so the NET ‘additional’ cost is $6,000 per year.

* Always run the numbers by your tax professional to understand the NET financial impact.

7. Faster Appreciation: When the market eventually rebounds, and interest rates decrease, there will be a pent-up demand for homes, potentially causing a quicker appreciation in property value for homeowners who bought when rates were high.

Barbara Corcoran recently said, “The minute those interest rates come down, all hell’s going to break loose and prices are going to go through the roof.” So, while rates are high, now may be the time to lock in lower prices, using creative solutions like rate buy-downs and seller credits to navigate the present costs.

8. Availability of Adjustable-Rate Mortgages (ARMs): If you believe that high-interest rates are temporary, you might opt for an adjustable-rate mortgage. ARMs often start with lower rates that could adjust downward in a more favorable rate environment. Likewise, you could also work with the seller and/or lender on a temporary rate buy down.

9. Real Estate as an Investment: If you’re an investor, high-interest rates could lead to lower property prices, making it a good time to buy. You could then rent out the property, and as mentioned earlier, consider refinancing when rates are more favorable.

Another benefit of the current landscape is that it may be one of the only times you’ll be able to have positive cashflow with an existing property. Texas is tough to cash flow because of property taxes, but if you can keep your existing mortgage in place and break even or cash flow on the property, it’s a GREAT time to pick up another property.

10. Lifestyle Factors: Sometimes the best time to buy a home is when it aligns with your personal circumstances—like a job relocation, family expansion, or other life events—regardless of the economic environment.