I wanted to share some information on what’s going on in the Austin real estate market and how it’s impacting both buyers and sellers!

First and foremost, according to Nerdwallet, Austin is still in the #1 spot in terms of large cities with hot real estate markets.

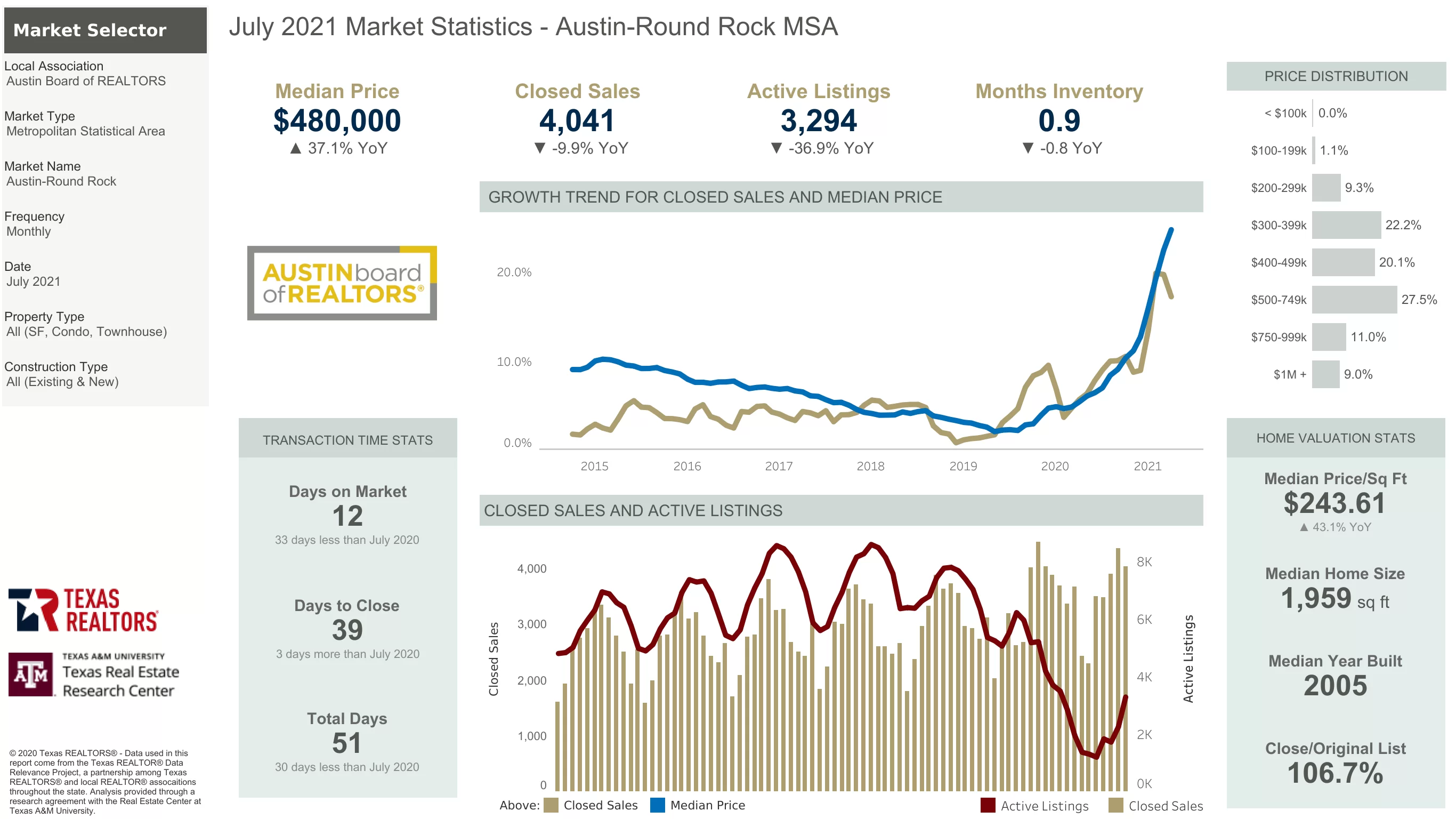

Austin also lands in the No. 1 spot in terms of large cities with hot real estate markets. Despite the fact that the number of home sales dropped by 9.9% year over year, prices increased 37.1% year over year.

Austin Market Update: August 2021

The challenge with looking strictly at “year over year” is that we all know that the last 18 months have been anything but typical and there were several months where activity was super low because of lockdowns and restrictions and then a big bounce. For example, July 2020 showed an increase of 20% over the previous year! But, April and May of the same year showed a decrease of 20% and 31% over April and May of 2019.

So, we need to look at the bigger picture.

What we know is that home values have increased… A lot!

We also don’t see signs of a bubble. The lending guidelines are still strict and buyers were cash-heavy for a while. In short, this means that they didn’t “overleverage” their home purchases. And since real estate values trail, what people WERE paying over and above asking a few months ago, is now the “value” since closed sales have caught up. We’re no longer seeing offers of 10-20-30% plus over asking as the norm.

We’re also seeing more inventory on the market.

This is giving buyers some much-needed relief as fatigue had set in during the spring when it was common for buyers to make many offers before getting one accepted.

Let’s look at how this information impacts both buyers and sellers!

BUYERS:

It means that you have options once again. You have a good chance of taking a look at 5-6 properties in a weekend, making an offer on your top 1-2 homes, and getting one accepted (pretty close to the list price, assuming it’s priced properly).

It means that appraisal waivers aren’t AS important.

And it means that sellers are generally back to paying for title, service contracts/warranties, etc.

And we’re also seeing fewer “free leasebacks” for sellers.

All that being said, we are STILL a strong seller’s market. Properly priced homes are averaging 12 DAYS on the market right now instead of 12-24 hours!!!

The number of active listings is similar to that of October 2020 (right before the market went wild, incidentally!)

We ARE still seeing homes appreciate, just at a more reasonable rate… So you can still capitalize on the long-term appreciation and still be a little more discerning.

Interest rates are still hovering at historic lows so your money goes a lot farther than it will as rates start to creep up (as is predicted next year).

PLUS, when you close before 12/31, you lock on the pricing for purposes of homestead caps moving forward.

SELLERS:

It means that properly pricing your home is essential. If you price it too high, you will likely wind up putting less in your pocket at the end of the day than if it had been priced correctly from the get-go! Buyers see price reductions and think that something is wrong or the seller is “motivated”.

Pricing needs to be based on the actual data in terms of current competition AND recent sales. I’m not saying we can’t push the envelope some, but we have to price realistically.

You’ll also see fewer people waiving appraisals and giving a pass on all the items on an inspection report. They’re asking for concessions once again on items beyond the major systems.

All that being said, we are STILL a strong seller’s market. Properly priced homes are averaging 12 days right now instead of 12-24 hours!!! While multiple offers are still out there, it’s not uncommon to get just one or two and have to negotiate through the terms.

The number of active listings is similar to that of October 2020 (right before the market went wild, incidentally!)

We ARE still seeing homes appreciate, just at a more reasonable rate…

While I don’t see any signs of a bubble or a massive correction, I can tell you that if interest rates start to creep up, as many experts predict they will into 2022, that buyers will be able to afford less and that will leave us with fewer buyers.

As with trying to time ANY kind of market – real estate, stocks, etc. – it’s a risky proposition! If you’re thinking of cashing out, then now might just be the right time to do so since home prices are at all-time highs.

One other thing to consider… We also don’t know what’s going to happen with capital gains moving forward.

Currently, if you’ve lived in your home as a primary residence for 2 of the past 5 years, your first $250,000 for a single person and $500,000 for married couples is TAX-FREE.

There is a good chance the long-term capital gains rates will increase. This will impact you if you make mor than $250k/$500k or if you’ve owned for less than a year. And who knows if Congress is going to try to attack this exclusion as well!

NOTE: Please consult your tax professional for your situation.

To discuss your personal situation and whether selling, buying, or BOTH might be the right option for you, give me a call or email me!