I hope you had a great week! For many of us here in Texas, we were trying to get back to normal after almost two weeks of being home, in many cases with kiddos!

In real estate, we’re starting to see some homes come on the market again (many had postponed due to storms and other folks have damage to repair prior to listing).

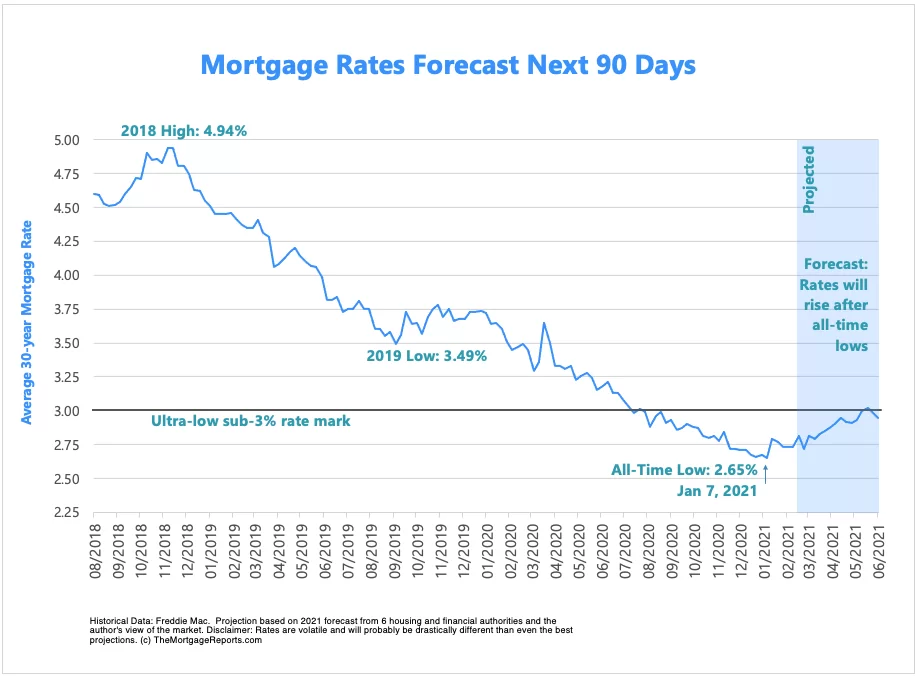

On another note… I’ve had several people ask me about mortgage rates on the rise so wanted to chat about that this week.

First, we are still at historic lows and it appears we’ll still be here through much of 2021, so DON’T PANIC if you’ve been trying to buy and have been missing out on contracts (or if you’re still trying to plan a trip to scout out the area).

Here’s what this means for you:

1. Keep an eye on rates and if you were close to what you could afford on your preapproval, periodically check in with your lender. (Property tax assessments will be coming out shortly as well and may impact your debt to income ratio)

For example, an increase 2.81 to 3.3 (.5%), on a $300,000 mortgage, represents a difference of $984/year or nearly $30,000 over the life of a 30-year mortgage.

2. While we have a lot of very well-qualified buyers, both cash and high equity buyers, as rates increase, this may reduce the buyer pool, especially in certain price points. This means there may be slightly less competition as interest rates rise.

NOTE: If you are looking to sell your home, this might be a good time to take the leap to maximize the number of buyers.

Have a great rest of your weekend and I look forward to connecting soon on your real estate plans in the coming year. Until next time… keep smiling… be kind… and stay safe out there 🙂